E-commerce Cash Flow Management: The Complete Guide for 2026

Why Cash Flow Management Matters for E-commerce

E-commerce businesses face unique cash flow challenges that differ significantly from traditional retail. According to Barclays, 35% of UK online retailers experienced cash flow difficulties in 2024, even while reporting revenue growth. The disconnect between sales and cash availability is a defining challenge of the industry.

The e-commerce cash flow problem is fundamentally one of timing. You pay for inventory, shipping, and marketing upfront, but receive payment days or weeks later—often after accounting for returns and chargebacks.

- Inventory investment—buying stock weeks or months before selling it; UK e-commerce businesses hold an average of £45,000 in inventory

- Payment processor holds—Stripe, PayPal, and others hold funds for 2-14 days depending on your account history

- Marketplace payment cycles—Amazon pays every 14 days, eBay weekly, creating predictable but delayed cash flow

- Seasonal spikes—Q4 can represent 40-50% of annual revenue, requiring significant upfront investment

- Returns and refunds—UK e-commerce return rates average 20-30%, meaning you ship and pay for items that come back

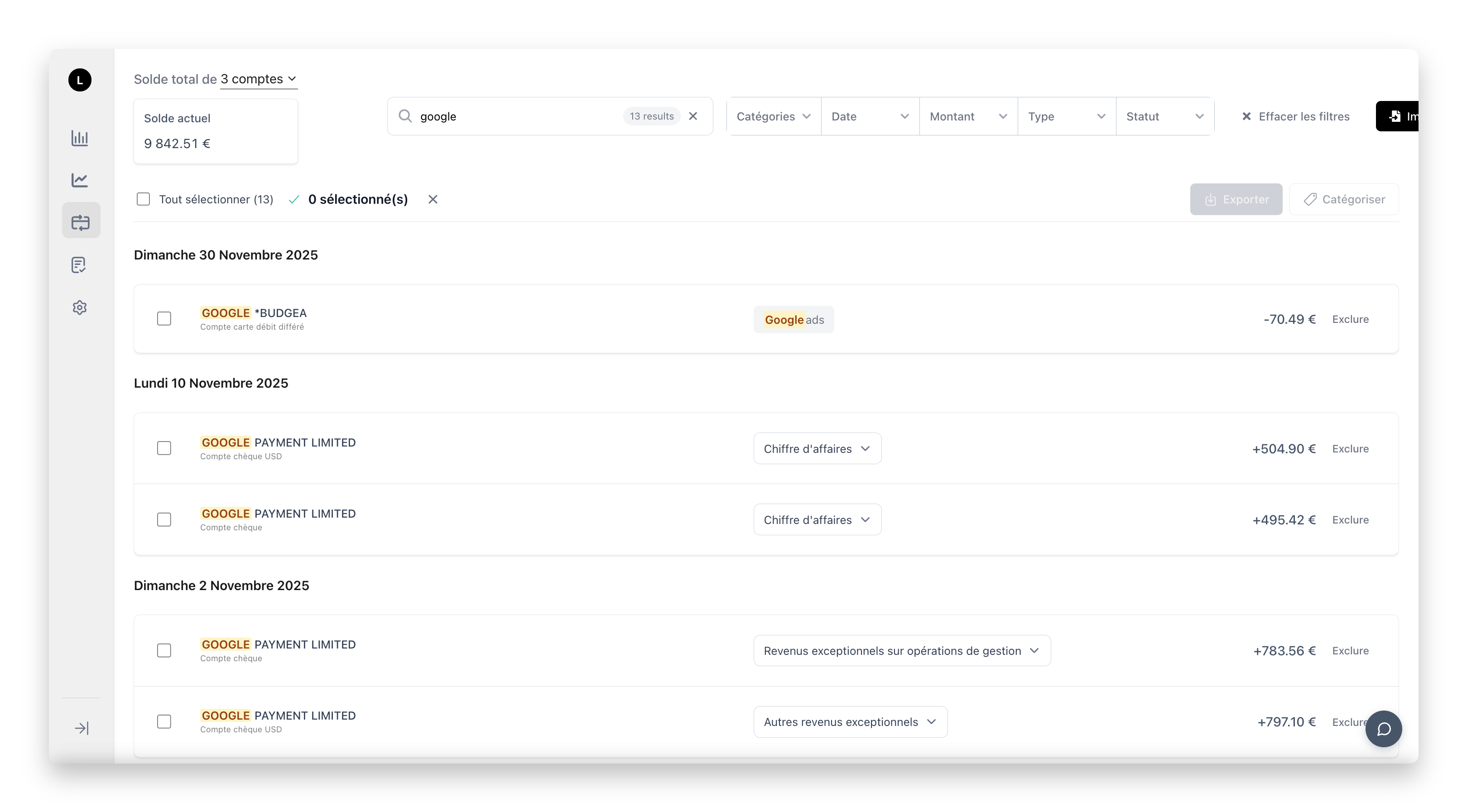

- Marketing spend timing—paying for Facebook and Google ads days or weeks before seeing conversion revenue

- Supplier deposits—especially for overseas manufacturers requiring 30-50% upfront payment

- Currency fluctuations—GBP/USD and GBP/EUR movements impact import costs and overseas sales

Research by IMRG shows that 28% of UK e-commerce businesses fail due to cash flow problems rather than lack of sales—making cash management arguably more important than marketing.

"You can have record sales and still run out of cash. I've seen sellers do £500K in Black Friday weekend and nearly go under because they'd spent everything on stock and couldn't pay their suppliers. E-commerce cash flow is about timing, not just revenue." — UK E-commerce Founder

Understanding E-commerce Cash Flow Dynamics

The fundamental equation of e-commerce cash flow is simple: you need to have money to buy stock before you can sell it. But the dynamics are complex, involving multiple payment timelines, seasonal variations, and operational costs.

The E-commerce Cash Conversion Cycle

The cash conversion cycle (CCC) measures how long cash is tied up in operations before returning as revenue:

CCC = Days Inventory Outstanding + Days Sales Outstanding - Days Payable Outstanding

Understanding each component:

- Days Inventory Outstanding (DIO)—how long stock sits before selling

- Days Sales Outstanding (DSO)—how long until payment processor releases funds

- Days Payable Outstanding (DPO)—how long you take to pay suppliers

UK e-commerce benchmarks:

- Average DIO: 30-60 days (inventory holding period); varies significantly by category

- Average DSO: 3-14 days (payment processor holds); new accounts face longer holds

- Average DPO: 30-45 days (supplier payment terms); longer for established relationships

- Typical CCC: 0-30 days for well-managed operations; negative CCC possible with pre-orders

A CCC of 45 days means every £1 of revenue ties up £1 of cash for 45 days. With £100K monthly revenue, that's £150K perpetually tied up in operations.

Cash Inflows for E-commerce

Understanding when money actually arrives in your account:

- Website sales (own store)—direct sales through Shopify, WooCommerce, etc.; settled in 2-7 days via Stripe/PayPal

- Amazon sales—largest UK marketplace; payment every 14 days after 7-day reserve period

- eBay sales—weekly payment schedule for managed payments sellers

- Etsy sales—daily deposits available for established sellers

- Wholesale orders—B2B sales to retailers; typically 30-60 day payment terms

- Pre-orders—cash received before inventory purchase; excellent for cash flow

- Subscription boxes—predictable recurring revenue; payment upfront each period

Cash Outflows for E-commerce

Variable Costs (typically 50-70% of revenue)

- Cost of goods sold: 30-50% of revenue (higher for commodities, lower for unique products)

- Shipping and fulfillment: 8-15% of revenue (higher for bulky/heavy items)

- Payment processing fees: 2-4% of revenue (Stripe 1.4-2.9%, PayPal 2.9%+)

- Marketplace fees: 8-20% on platforms (Amazon 15%, eBay 12-15%, Etsy 6.5%)

- Returns processing: 2-5% of revenue (return shipping, restocking, damaged goods)

- Packaging materials: 1-3% of revenue (boxes, tissue, tape, inserts)

Fixed Costs (typically 20-35% of revenue)

- Marketing and advertising: 10-25% of revenue (Facebook, Google, influencers)

- Staff and contractors: 5-15% (customer service, packing, photography)

- Software subscriptions: 2-5% (Shopify, email marketing, inventory management)

- Warehouse and storage: 2-5% (3PL costs or own facility)

- Professional services: 1-3% (accountant, legal, consultants)

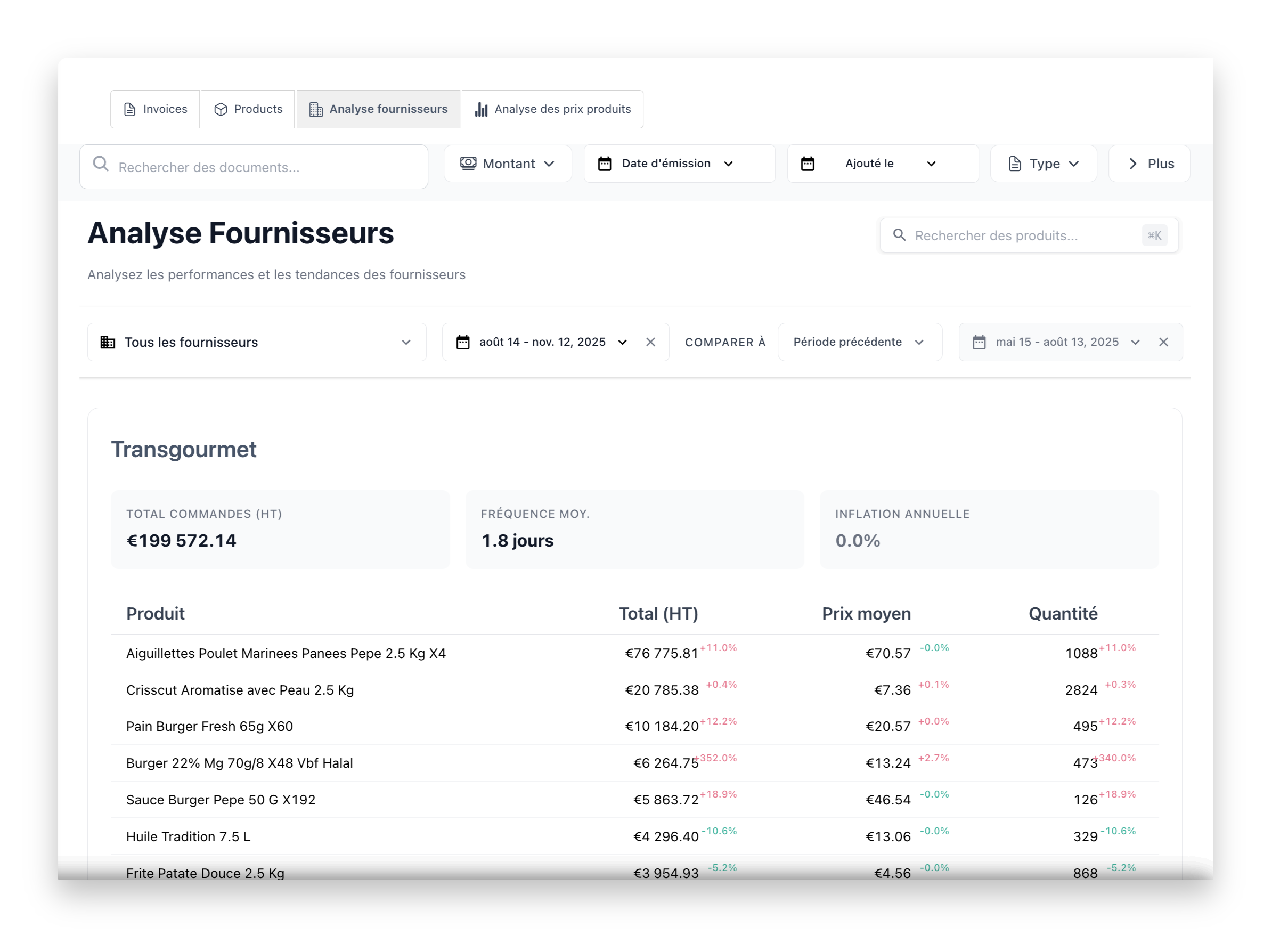

Managing Inventory Cash Flow

Inventory is the biggest cash drain for most e-commerce businesses. Every pound tied up in stock is a pound you can't use for marketing, operations, or growth.

Inventory Turnover Optimization

Inventory turnover measures how efficiently you convert stock to sales:

Inventory Turnover = Cost of Goods Sold ÷ Average Inventory Value

UK e-commerce benchmarks by category:

- Fashion and apparel: 4-6 turns per year (size/colour variants create complexity)

- Electronics and gadgets: 6-10 turns per year (shorter product lifecycles)

- Home and garden: 4-6 turns per year (seasonal variation)

- Health and beauty: 6-8 turns per year (expiration dates drive faster turns)

- Pet supplies: 8-12 turns per year (consumables drive repeat orders)

- Jewellery and accessories: 3-5 turns per year (higher margins offset slower turns)

ABC Analysis for Cash Flow

Classify inventory by contribution to revenue:

- A items (20% of SKUs, 80% of revenue): Never stock out; invest in safety stock

- B items (30% of SKUs, 15% of revenue): Moderate investment; regular reordering

- C items (50% of SKUs, 5% of revenue): Minimise investment; consider drop shipping

Inventory Management Strategies

- Just-in-time ordering—reduce stock holding where lead times allow; works best with UK/EU suppliers

- Drop shipping—eliminate inventory risk for certain products; accept lower margins

- Pre-orders and crowdfunding—validate demand and collect cash before purchasing stock

- Consignment arrangements—negotiate stock-on-consignment with suppliers for new lines

- Flash sales and bundles—clear slow-moving inventory quickly; recover cash tied up in dead stock

- Seasonal markdown planning—planned promotions to clear end-of-season stock

- Cross-docking—ship directly from supplier to customer without warehousing

Supplier Payment Strategies

Optimising how and when you pay suppliers directly impacts cash flow:

- Negotiate extended terms—move from Net-30 to Net-60 or Net-90 as you grow

- Early payment discounts—2/10 Net-30 means 2% discount for paying in 10 days (36% annualised return)

- Deposit structures—negotiate 30% deposit/70% on delivery vs 50/50

- Consolidated shipments—fewer, larger orders reduce shipping costs and may improve terms

- Letters of credit—for overseas suppliers, defer payment until goods arrive

Navigating Payment Processor Timing

Payment timing significantly impacts e-commerce cash flow. The gap between making a sale and receiving funds can strain your working capital.

Payment Processor Settlement Times

- Stripe: 7 days for new accounts, reducing to 2 days as you build history; instant payouts available for 1% fee

- PayPal: Instant to PayPal balance, 3-5 business days to bank; new accounts may face 21-day holds

- Shopify Payments: 3-5 business days standard; faster for Shopify Capital users

- Square: Next business day; one of the fastest processors

- Klarna/Clearpay: 2-5 days; you receive full amount minus fees, they handle BNPL risk

- Amazon Pay: 7 days for new sellers, reducing over time

Marketplace Payment Cycles

- Amazon UK: Every 14 days, with 7-day reserve for new sellers; monthly disbursement option available

- eBay Managed Payments: Weekly for established sellers; daily available after criteria met

- Etsy: Daily deposits available; 3-day hold on first £50 for new sellers

- Wayfair: Weekly payment for partners

- Not On The High Street: Monthly payment, Net-30 after month end

Optimizing Payment Collection

- Build payment history—consistent sales volume reduces processor hold periods over time

- Use multiple payment processors—hedge timing risk across different settlement schedules

- Offer bank transfer for large orders—B2B customers may prefer this; faster settlement

- Consider instant payout services—Stripe Instant Payouts (1% fee) for urgent cash needs

- Minimise chargebacks and disputes—processors increase holds for high-risk accounts

- Maintain low refund rates—excessive refunds trigger payment holds

Managing Returns and Refunds

Returns are a significant cash flow challenge unique to e-commerce:

UK E-commerce Return Rates

- Fashion and apparel: 25-40% return rate

- Footwear: 30-35% return rate

- Electronics: 10-15% return rate

- Home goods: 10-20% return rate

- Beauty: 5-10% return rate

Cash Flow Impact of Returns

- You've already paid for the product and shipping

- Return shipping costs (if you offer free returns)

- Restocking and quality checking time

- Some items can't be resold as new

- Payment processor fees are often non-refundable

Reducing Return Impact

- Detailed product descriptions and images—reduce "not as expected" returns

- Size guides and fit tools—essential for fashion sellers

- Customer reviews—help set accurate expectations

- Quality control—reduce defective item returns

- Exchanges over refunds—retain the sale even if item changes

- Store credit incentives—offer bonus credit for choosing store credit over refund

Managing Seasonal Cash Flow

UK e-commerce seasonality creates pronounced cash flow peaks and troughs:

Key UK E-commerce Dates

- Black Friday/Cyber Monday: UK online spending hit £9.4 billion in November 2024

- Christmas peak: November-December represents 25-40% of annual sales for many sellers

- January sales: High volume, lower margins; clear Christmas stock

- Valentine's Day: Key for gifts, jewellery, flowers

- Mother's Day (UK): Major sales day for gifts and flowers

- Summer slowdown: July-August sees 20-30% revenue dip for many categories

- Back to school: August-September spike for relevant categories

Seasonal Cash Flow Planning

- Build cash reserves during strong months—save 20-30% of Q4 profits for Q1 cash needs

- Negotiate extended supplier terms for Q4—many suppliers will offer 60-90 days for Christmas stock

- Use inventory financing for seasonal build-up—revenue-based financing bridges the gap

- Plan marketing spend around cash availability—front-load spend only when cash allows

- Stagger inventory purchases—multiple smaller orders vs one large order

- Pre-sell where possible—"coming soon" listings generate early revenue

E-commerce Financing Options

UK-Specific Financing Solutions

- Revenue-based financing (Clearco, Uncapped, Wayflyer): Advance based on historical sales; repay as percentage of future revenue

- Inventory financing: Fund stock purchases against future sales; useful for seasonal build-up

- Marketplace lending (Amazon Lending, PayPal Working Capital): Pre-approved offers based on platform sales history

- Invoice factoring: For B2B e-commerce with wholesale customers on payment terms

- Business credit cards: Useful for short-term bridging; 0% periods available

- Peer-to-peer lending (Funding Circle): Alternative to traditional bank loans

- Asset-based lending: Secured against inventory for larger operations

When to Use Financing

- Good use: Funding proven, profitable inventory purchases for peak season

- Good use: Bridging payment processor delays while scaling

- Bad use: Funding unproven products or marketing experiments

- Bad use: Covering ongoing losses without path to profitability

Warning Signs of Cash Flow Problems

Watch for these red flags:

- Delaying supplier payments—first sign of cash stress

- Increasing reliance on credit cards—bridging gaps with personal credit

- Stocking out of bestsellers—can't afford to reorder top products

- Turning down profitable opportunities—can't fund inventory for new channels

- Rising days payable outstanding—taking longer to pay suppliers

- Increasing dead stock—cash trapped in unsellable inventory

- Declining cash reserves—buffer eroding month over month

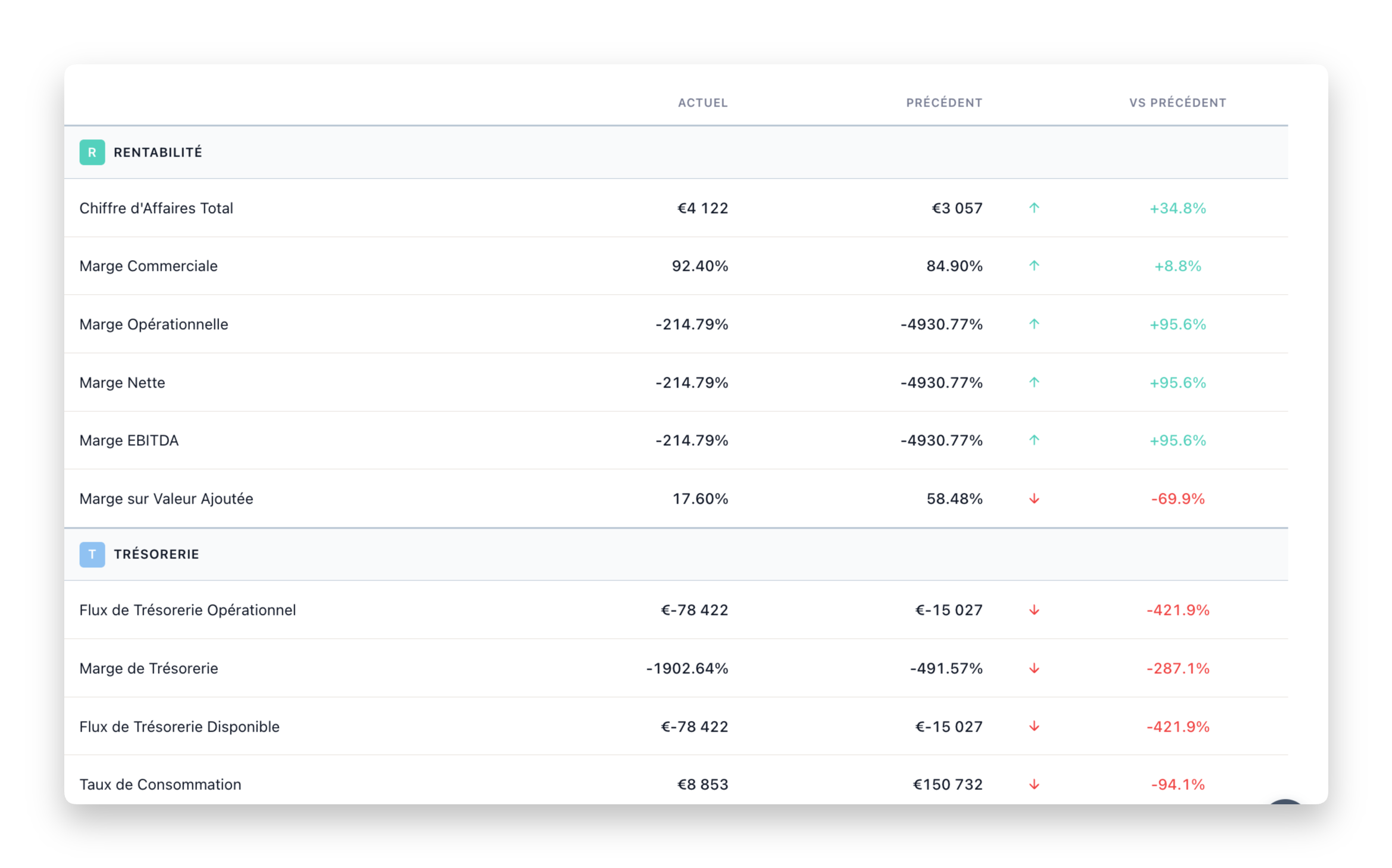

Key E-commerce Cash Flow Metrics

Track these metrics weekly:

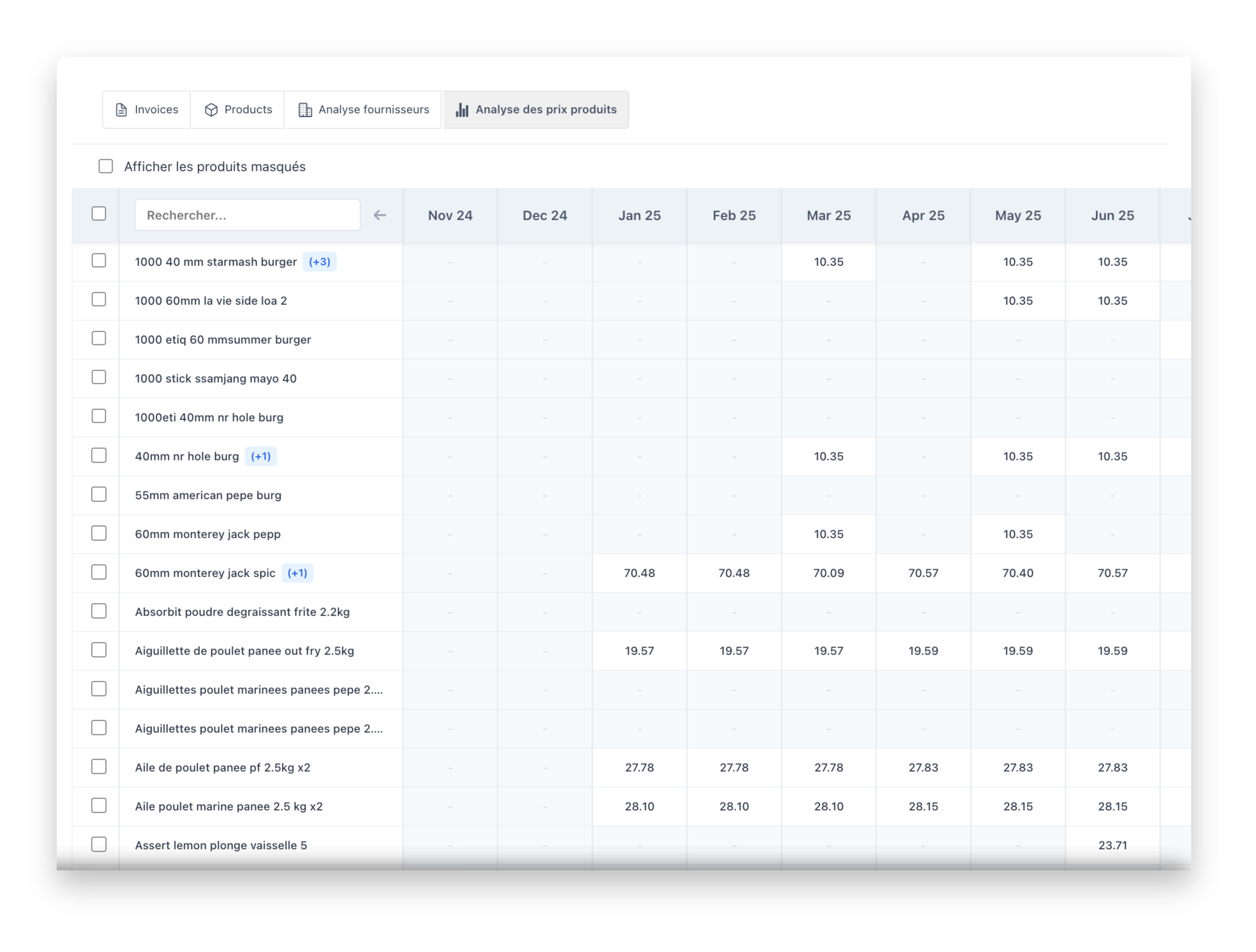

- Cash conversion cycle: Days to convert inventory investment to cash

- Inventory turnover: Times stock sells per year by category

- Gross margin: Revenue minus COGS (target: 40-60%)

- Return rate: Percentage of orders returned by category

- Customer acquisition cost: Marketing spend per new customer

- Cash runway: Months of operation at current burn rate

- Days sales of inventory: How long current stock will last

- Average order value: Higher AOV improves unit economics

Action Steps for Better E-commerce Cash Flow

This Week

- Calculate your cash conversion cycle across all channels

- Review inventory turnover by product category and SKU

- Check payment processor settlement timing and fees

- Identify your top 5 cash-draining SKUs (slow sellers tying up capital)

- Review your return rate trends by category

This Month

- Negotiate better supplier payment terms on your top 3 suppliers

- Implement inventory reorder alerts to prevent overstocking

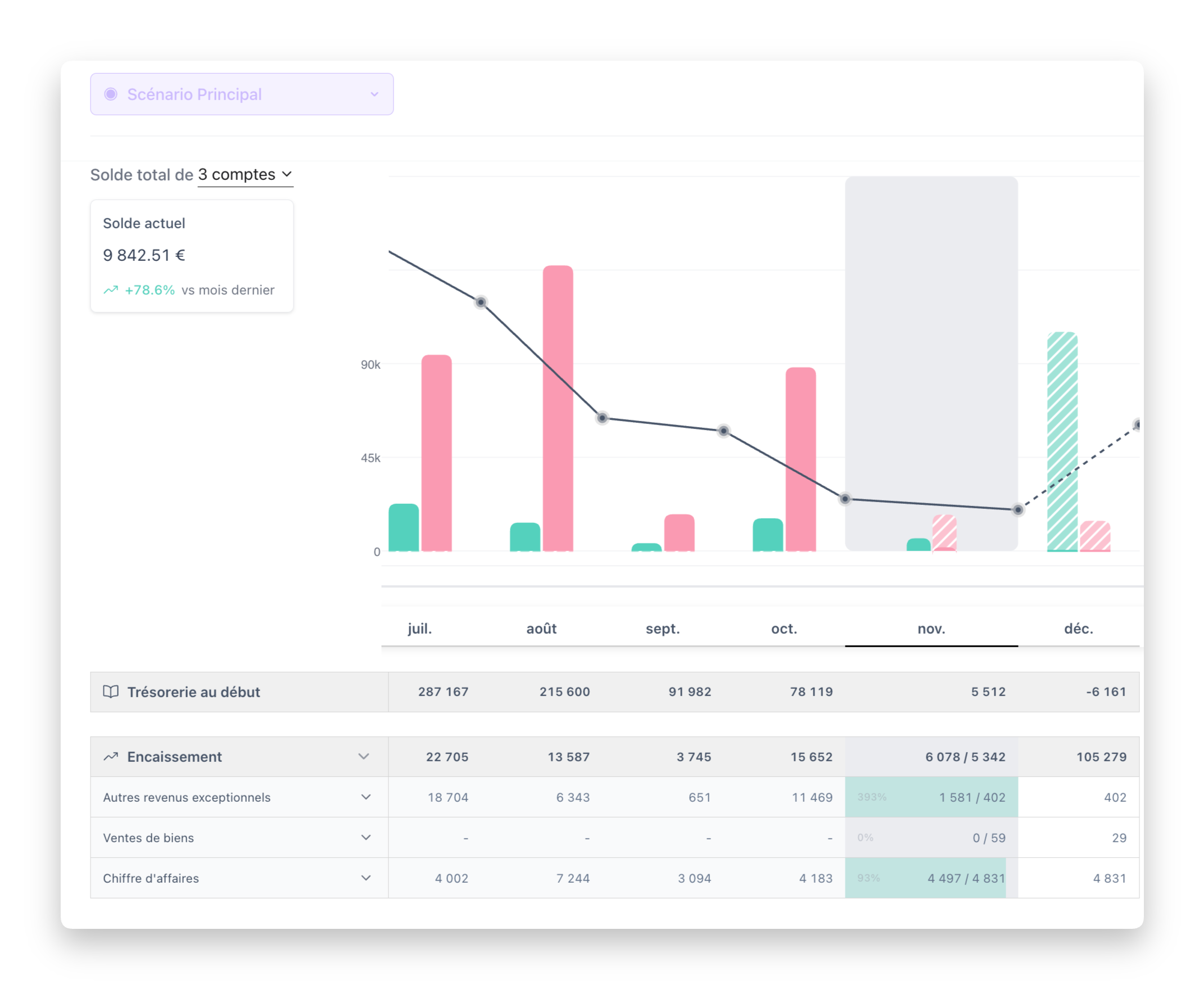

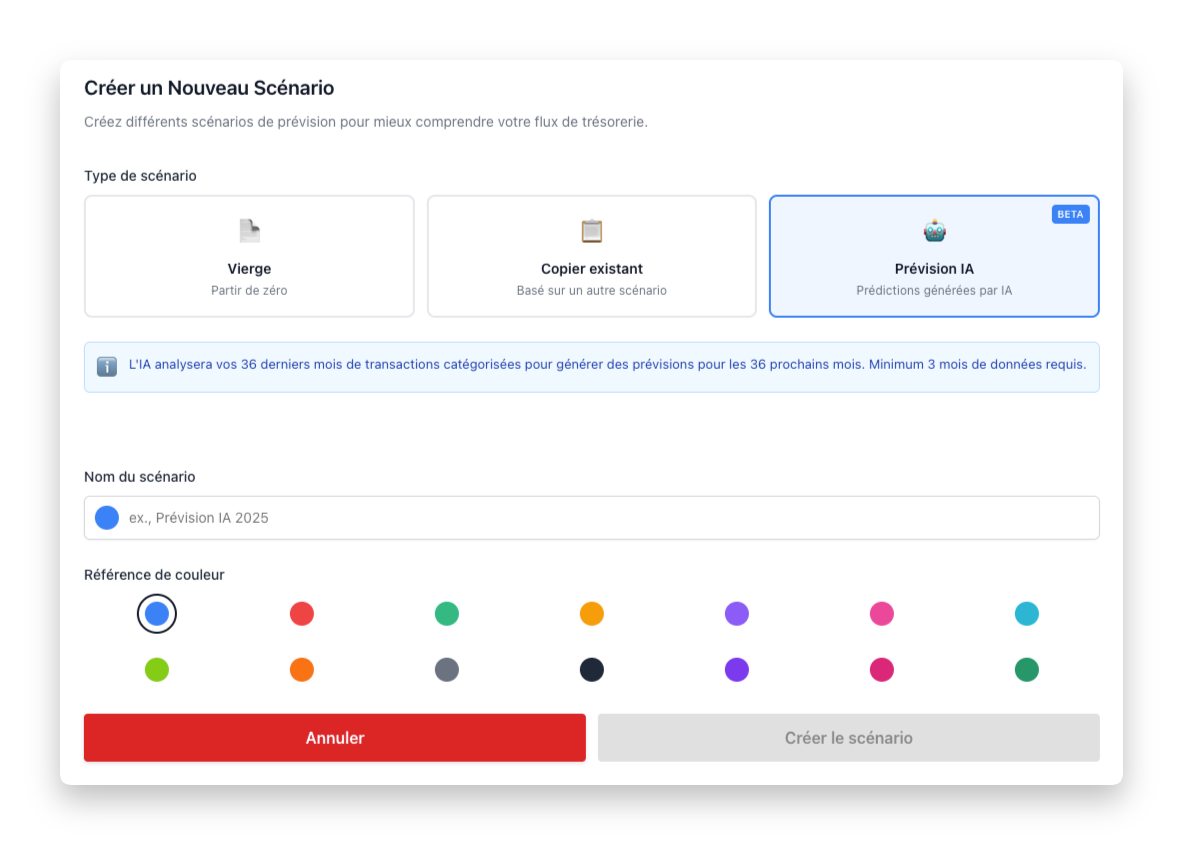

- Create a 13-week rolling cash flow forecast

- Run a flash sale to clear slow-moving stock and release cash

- Review payment processor options for better settlement terms

This Quarter

- Build 3-month operating expense cash reserve

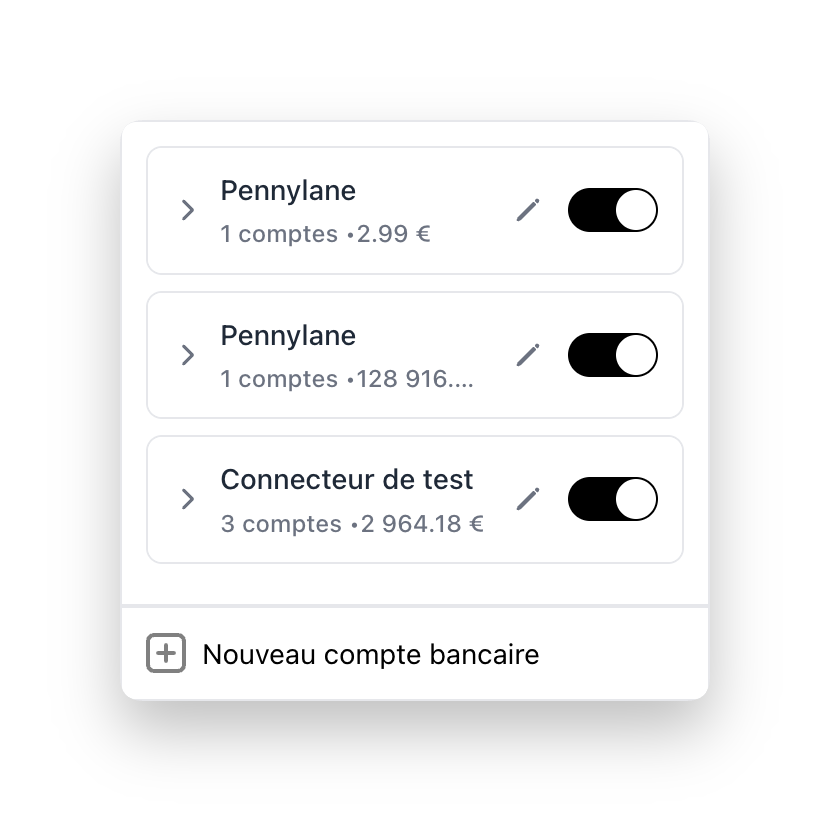

- Implement cash flow management tooling with real-time visibility

- Explore inventory financing options for seasonal preparation

- Optimize product mix for cash flow efficiency (faster-turning items)

- Review and reduce return rates through better product information

Conclusion

E-commerce cash flow management is fundamentally about timing—when you pay for stock versus when you receive payment for sales. The businesses that master this timing challenge can grow faster, survive seasonal volatility, and capitalise on opportunities that cash-strapped competitors must pass up.

By optimising inventory turns, understanding payment cycles across all your sales channels, planning for seasonality, and maintaining healthy cash reserves, you can build a more resilient online business.

Start taking control of your e-commerce cash flow today—your ability to grow and scale depends on it.