Products

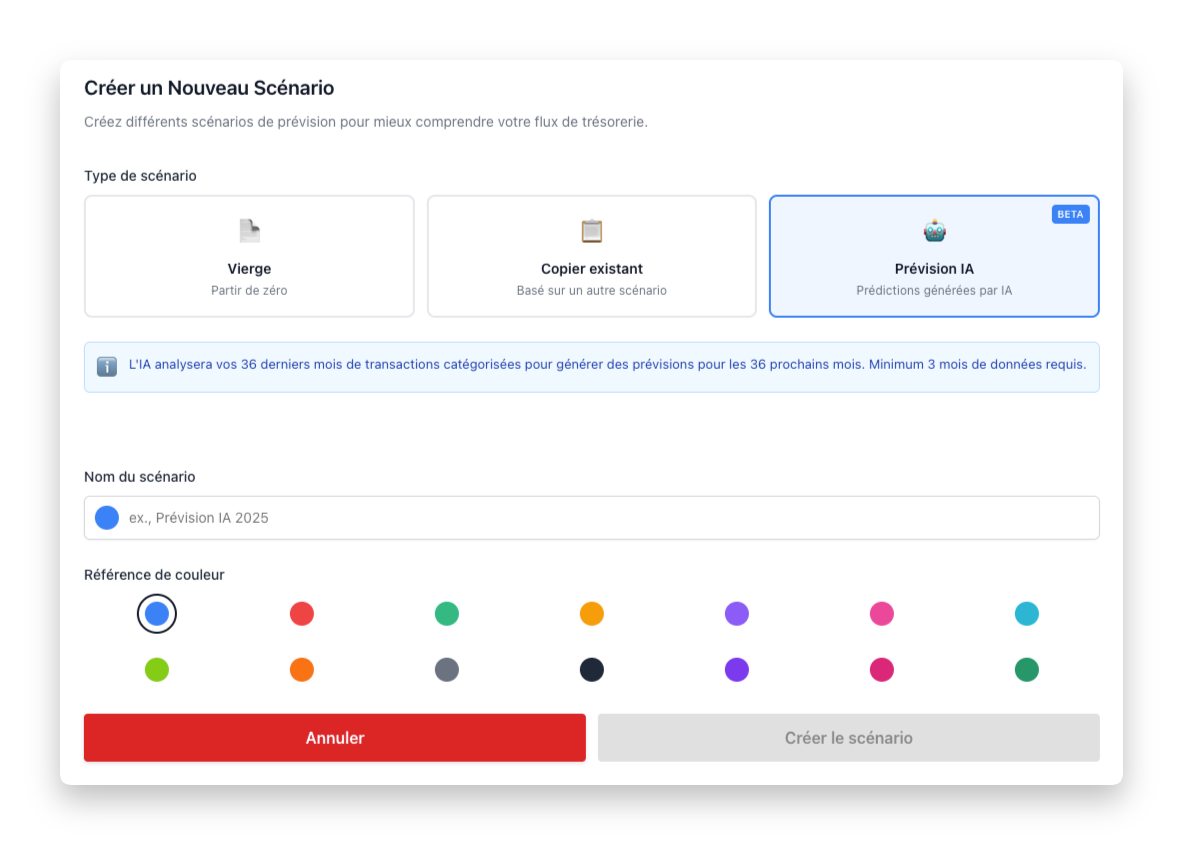

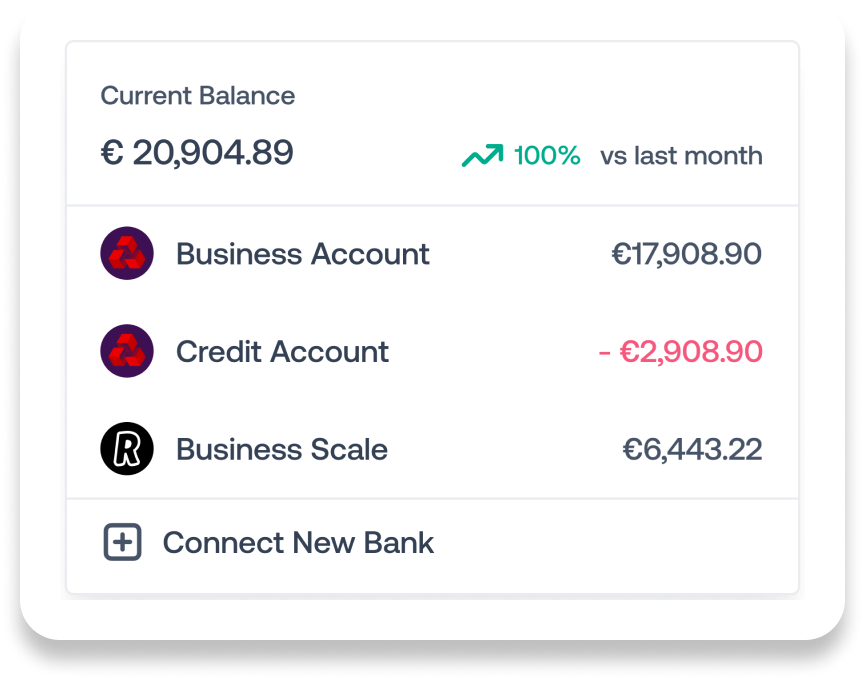

Cash Flow Management

Real-time tracking and AI-powered forecasting

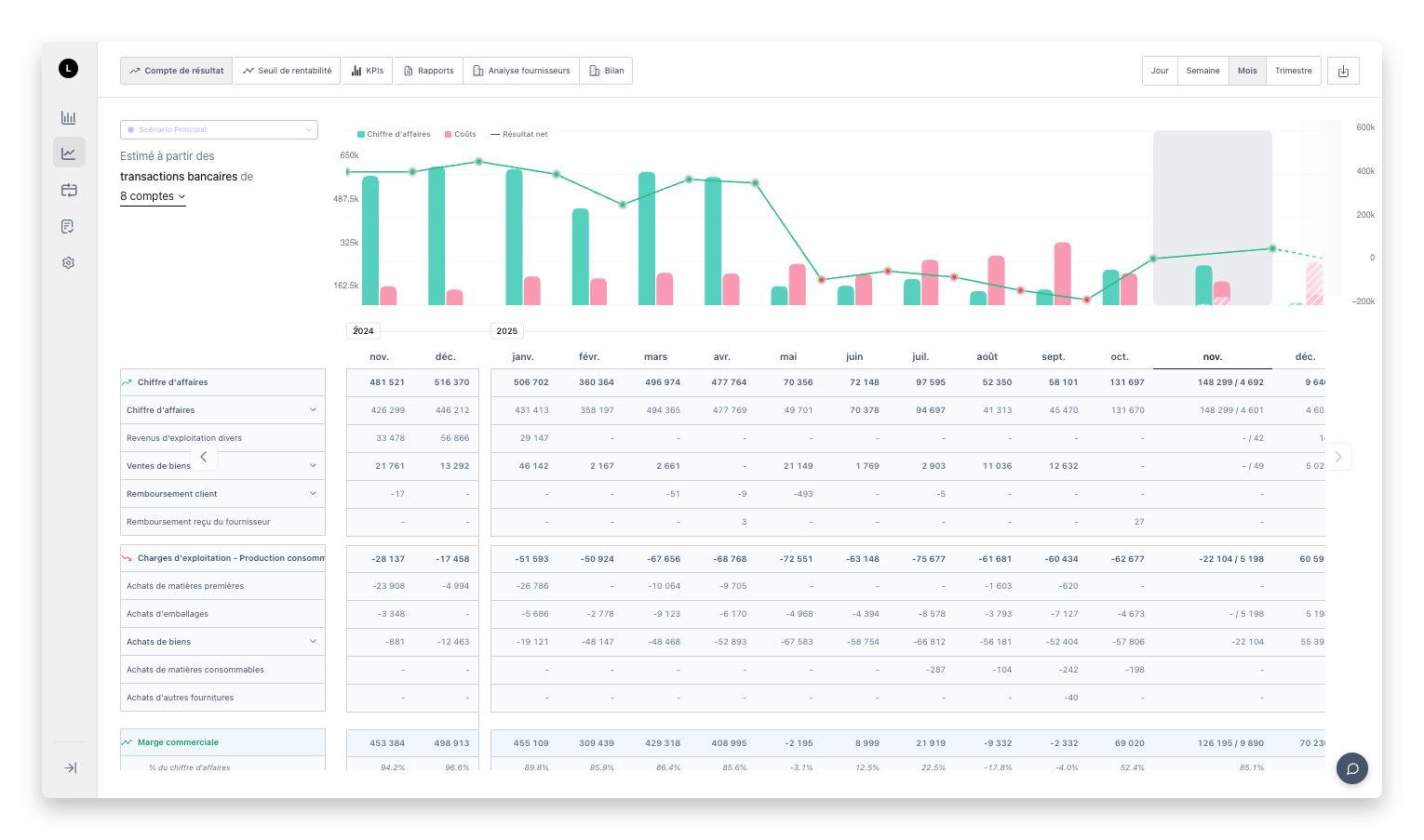

Performance Analytics & KPIs

P&L, KPIs, and comprehensive financial insights

Break-Even Calculator

Interactive break-even analysis and profitability planning

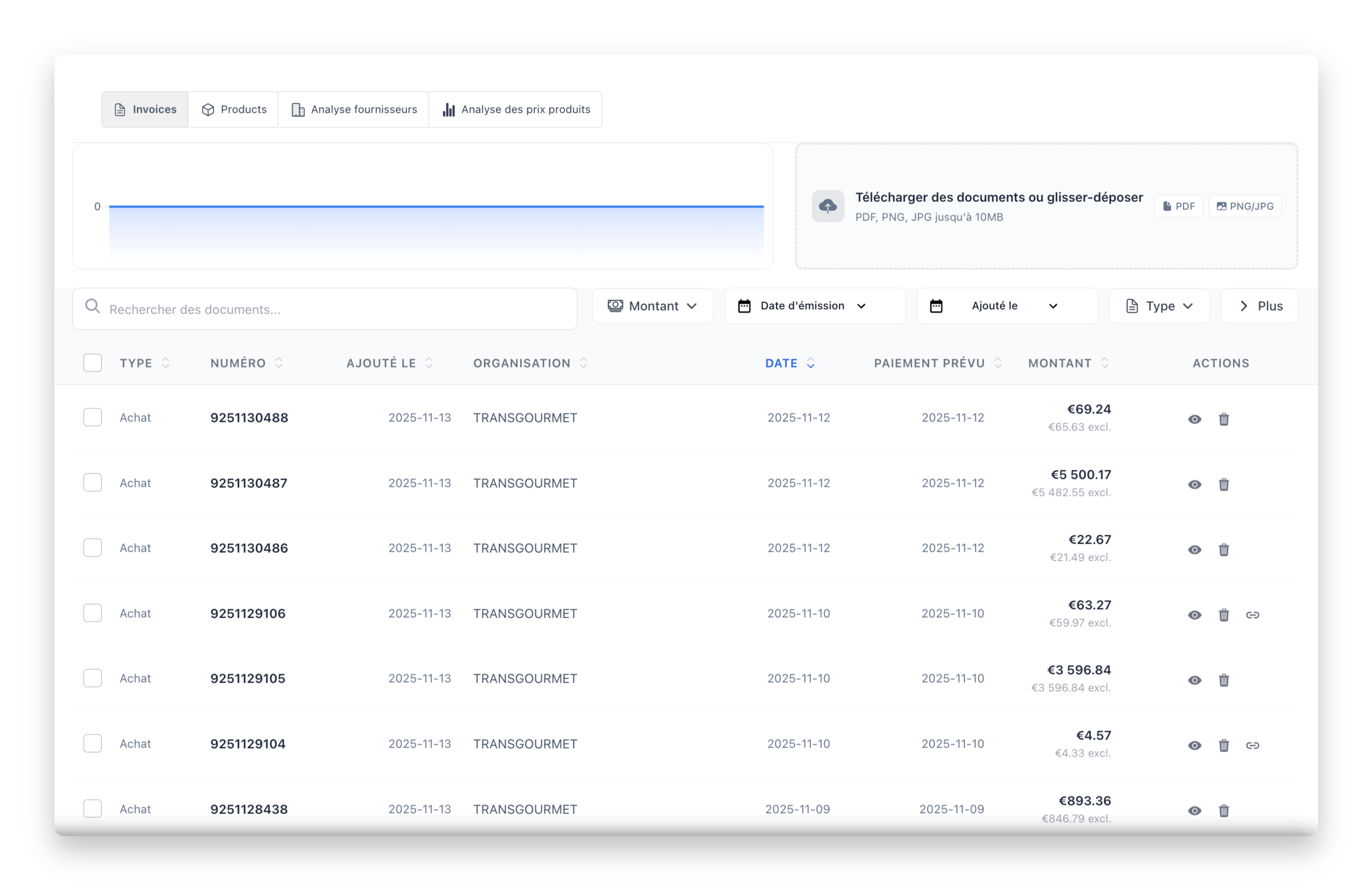

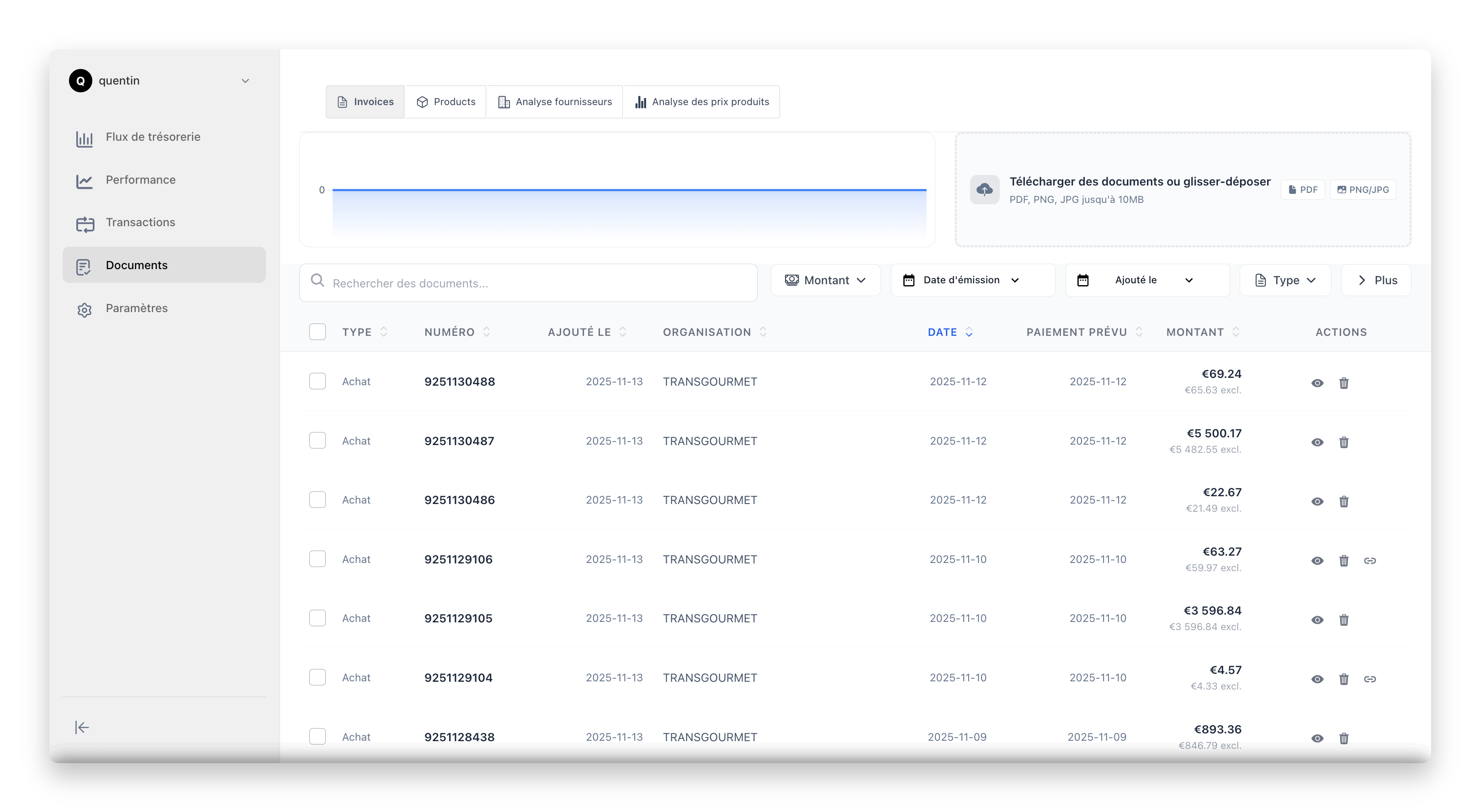

Document Management Hub

AI-powered invoice and receipt management

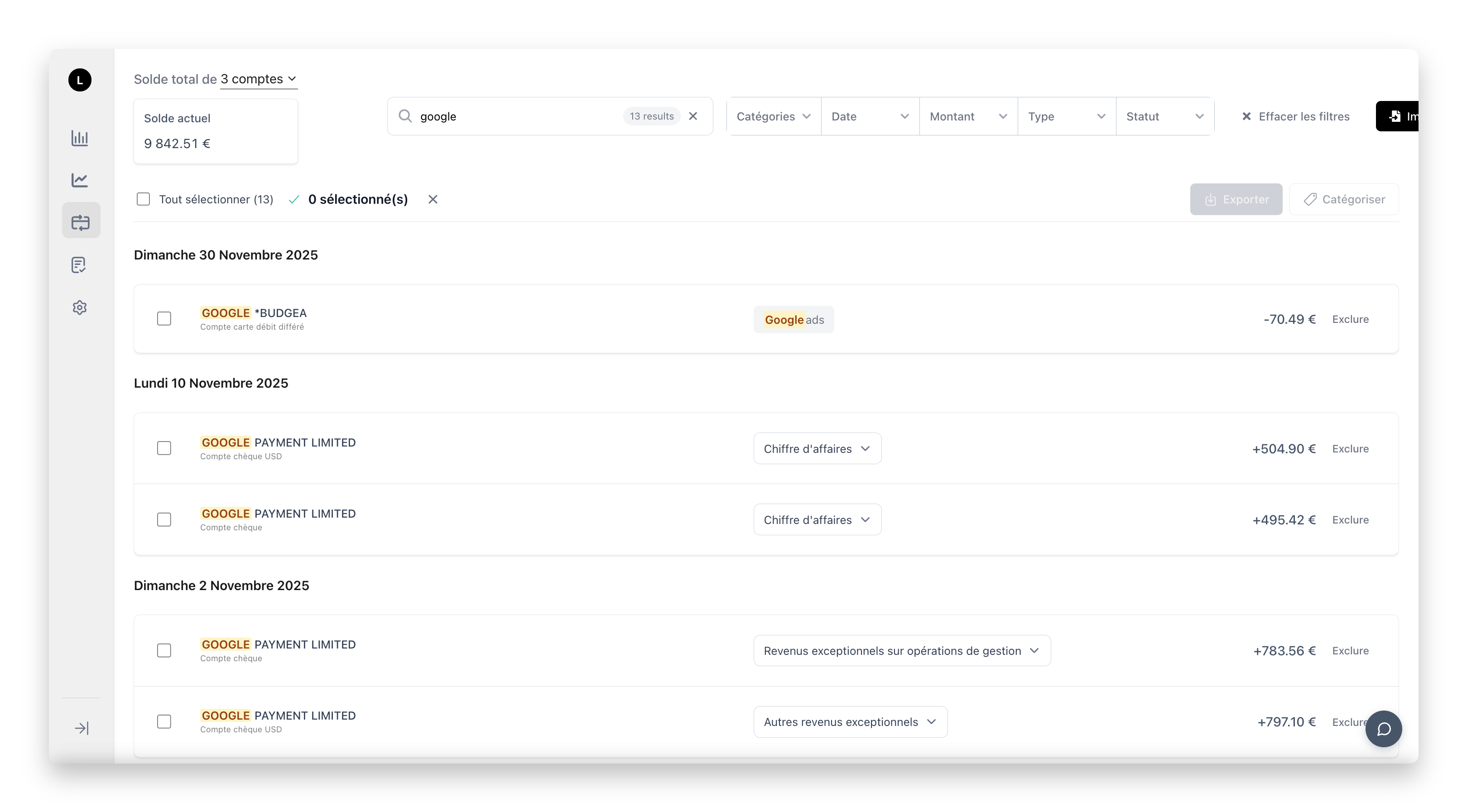

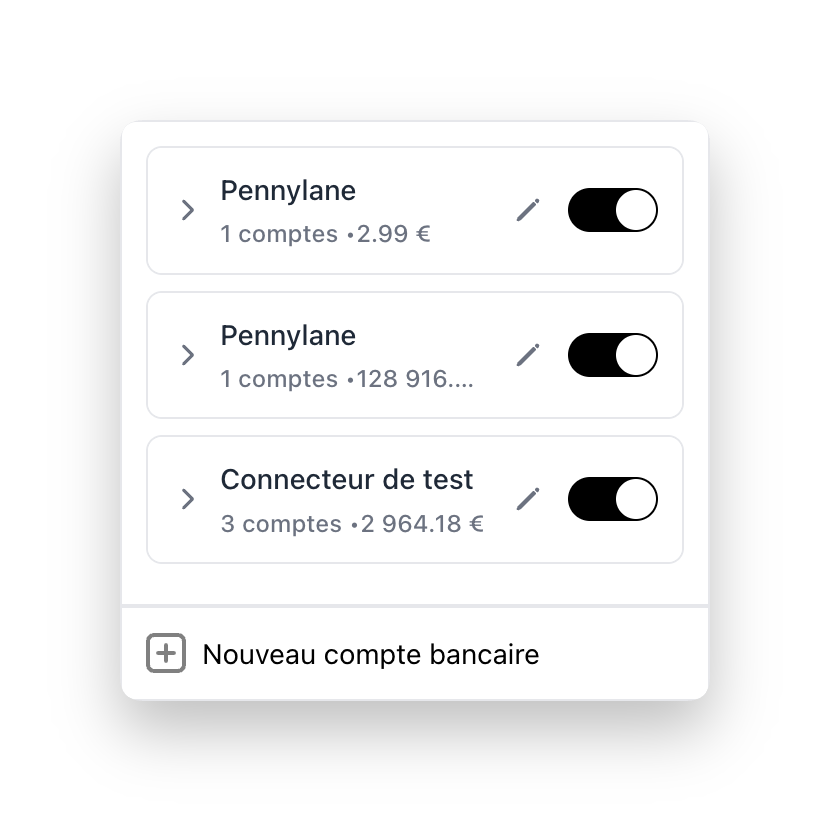

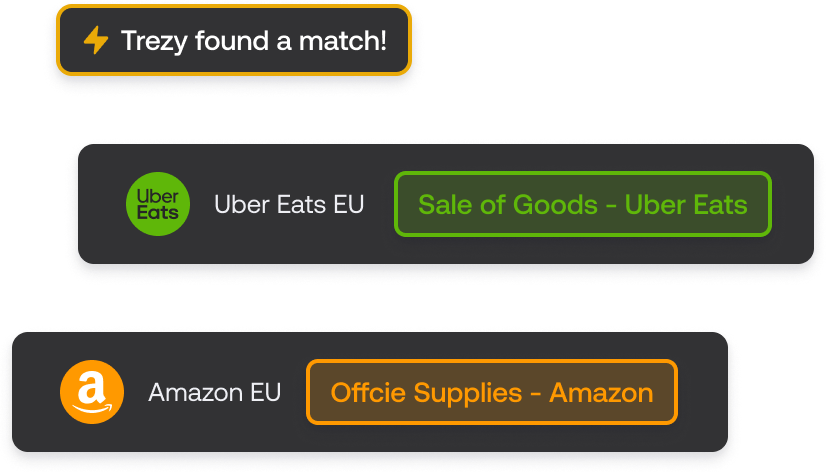

Transaction Management

Multi-bank sync with intelligent categorization

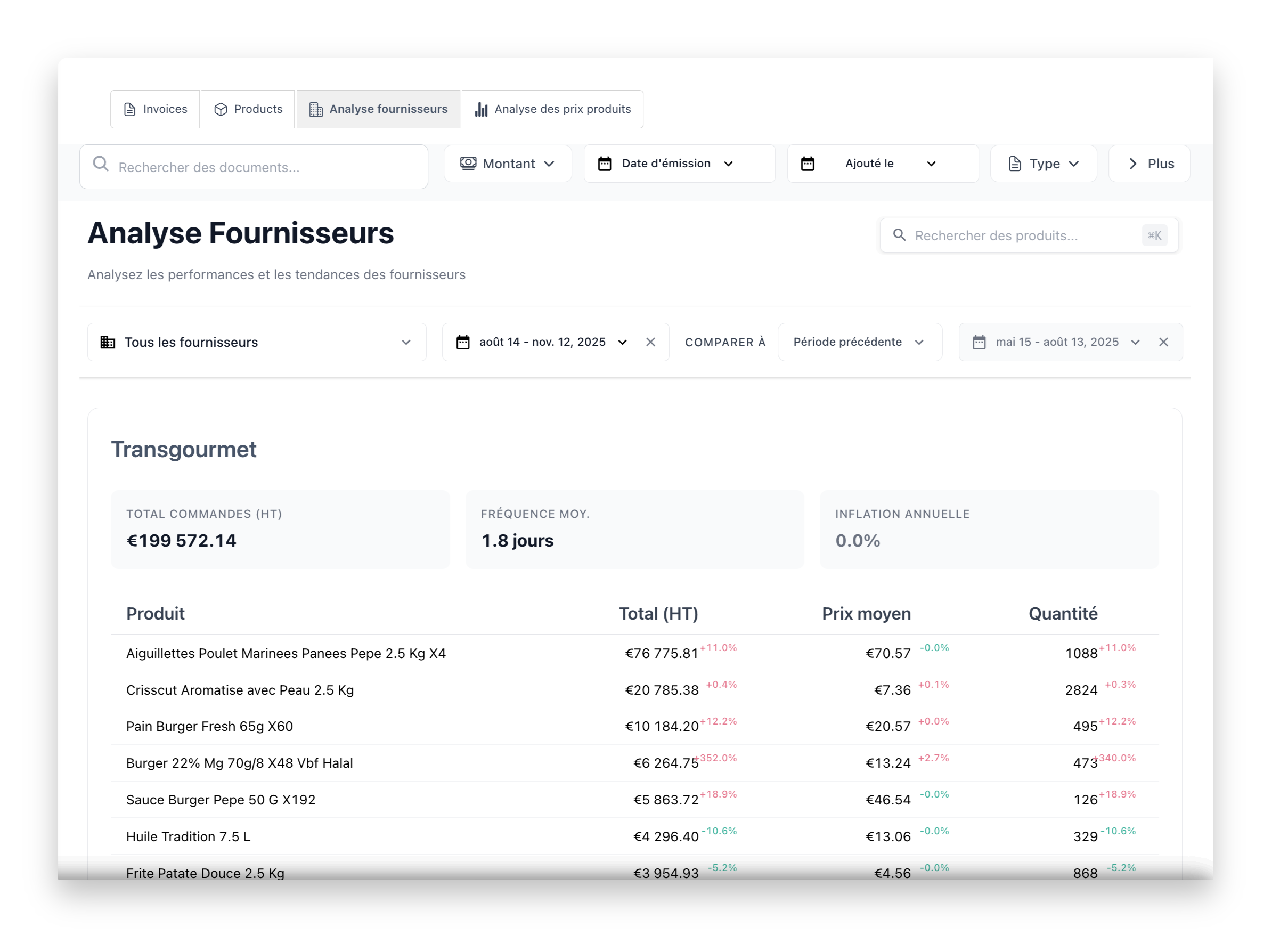

Supplier Analysis & Cost Intelligence

Real-time inflation tracking and spend optimization